Life insurance is key to financial planning, offering a safety net for you and your family. With many options, picking the right policy can feel daunting. The right life insurance brings financial security and peace of mind.

Exploring different life insurance options is crucial to find the best one for you. Life insurance might seem complex, but understanding the basics helps you make a smart choice. Your goal is to find a policy that fits your lifestyle and offers the right coverage.

A striking visual representation of diverse life insurance options, showcasing a vibrant, modern cityscape with skyscrapers and residential buildings in the background. In the foreground, a group of people, each representing different demographics, genders, and ages, stand together, conveying a sense of community and financial security. The scene is bathed in warm, golden lighting, creating a sense of optimism and hope. The overall composition emphasizes the range of life insurance options available, catering to the diverse needs of individuals and families. The image should evoke a feeling of confidence and empowerment in the viewer, reflecting the article’s focus on discovering the best life insurance options.

The right life insurance policy can greatly impact your family’s future. It’s important to research and compare various options to find the best fit. This way, you can ensure your loved ones are protected.

Introduction to Life Insurance

In today’s world, life insurance is more vital than ever. It offers security and stability, helping you plan for the future confidently. With the right policy, you can be sure your family is cared for, no matter what.

Key Takeaways

- Life insurance provides a safety net for individuals and their families

- There are many insurance options available, and it’s essential to find the best fit for your needs

- The best life insurance can provide financial security and peace of mind

- Research and compare different insurance options to find the one that works best for you

- Having the right life insurance policy can make a significant difference in securing your family’s future

- Life insurance is a crucial aspect of financial planning

Understanding Life Insurance Basics

Life insurance is key to financial planning, offering a safety net for loved ones. It’s a contract between you and the insurance company. They agree to pay a death benefit to your beneficiary in exchange for your premium payments. This Insurance Coverage can be customized to fit your needs, offering more than just financial protection.

Exploring Life Insurance Basics means looking at different types of policies. You’ll find term life, whole life, and universal life insurance. Each has its own benefits and features. Knowing the differences helps you choose the right Insurance Coverage for you.

What is Life Insurance?

Life insurance acts as a financial safety net for dependents. It helps cover funeral costs, debts, and living expenses. The Benefits of Life Insurance go beyond money, giving peace of mind to both you and your loved ones.

How Life Insurance Works

Getting life insurance involves a medical exam and a detailed application. After approval, you pay premiums to keep your coverage. The insurance company then pays a death benefit to your beneficiary if you pass away.

Key Benefits of Coverage

The Benefits of Life Insurance are many:

- Financial protection for dependents

- Payment of funeral expenses and outstanding debts

- Supplemental income for loved ones

- Tax-free death benefit

Understanding life insurance basics helps you make smart choices about your Insurance Coverage. Whether you’re new to Life Insurance Basics or updating your policy, think about your unique needs. This ensures you get the right coverage for you.

Types of Life Insurance Policies Available Today

There are many Life Insurance Policies to pick from. Knowing the different Types of Life Insurance helps you make a smart choice. You’ll find term life, whole life, universal life, and variable life insurance among the most common.

Each Insurance Option has its own benefits and flexibility. For instance, term life covers you for a set time. Whole life insurance, on the other hand, lasts your whole life. Universal and variable life insurance let you adjust premiums and investments.https://www.youtube.com/embed/OFU3Js7crYE

- Term life insurance: provides coverage for a specified period

- Whole life insurance: offers lifetime coverage

- Universal life insurance: offers flexibility in terms of premiums and investment options

- Variable life insurance: offers investment options and potential for cash value growth

By learning about the different Types of Life Insurance and Insurance Options, you can pick the Life Insurance Policies that suit you best. This way, you can find the right fit for your needs and budget.

Determining How Much Life Insurance Coverage You Need

Choosing the right Life Insurance Coverage is a big decision. It’s key to make sure your loved ones are taken care of if you’re not there. You’ll need to think about your income, expenses, debts, and goals to figure out how much coverage you need.

Your specific situation will affect how much coverage you need. For example, if you have a big mortgage or debts, you might need more coverage. But, if you have a lot of savings, you might need less. Financial Planning helps you find the right amount for your needs.

When figuring out your coverage needs, consider a few things:

- How much income would your family need to keep their lifestyle if you were gone?

- Do you want to pay off debts like your mortgage or car loans when you pass away?

- Think about the cost of your children’s education, including college.

- Don’t forget to include the cost of your funeral and other final expenses.

By thinking about these factors and planning well, you can find the right Life Insurance Coverage. This ensures your loved ones are taken care of.

It’s also important to check and update your Life Insurance Coverage often. You might need to change the amount or who gets the money. Keeping your coverage up to date gives you peace of mind for your loved ones.

| Factor | Consideration |

|---|---|

| Income replacement | Calculate how much income your loved ones would need to maintain their current standard of living |

| Debt repayment | Determine how much debt you would like to pay off in the event of your passing |

| Education expenses | Consider the cost of funding your children’s education, including college tuition and other expenses |

| Funeral expenses | Calculate the cost of your funeral and other final expenses |

Term vs. Permanent Life Insurance: Making the Right Choice

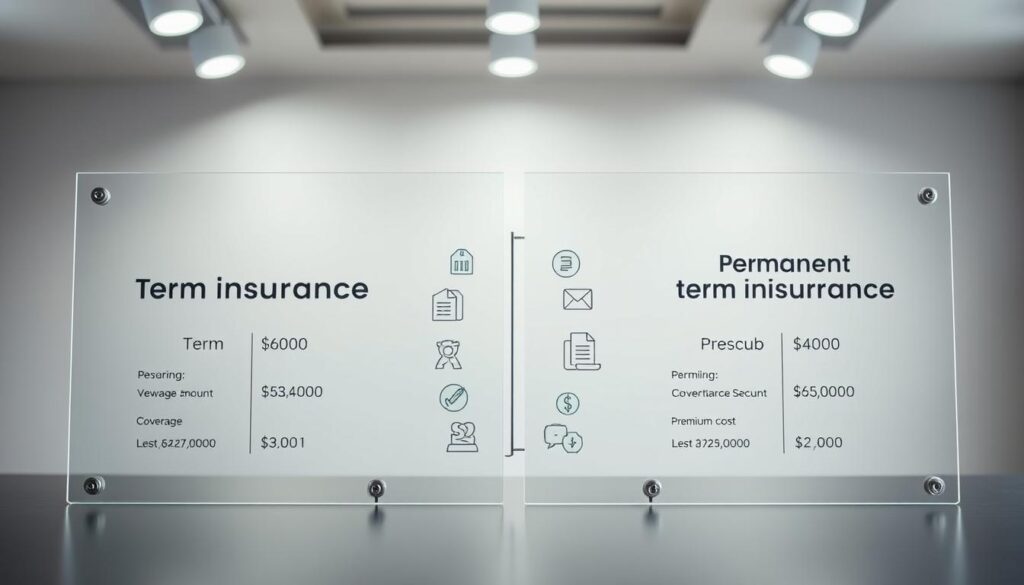

When choosing Insurance, you have two main options: Term Life Insurance and Permanent Life Insurance. Term Life covers you for a set time, while Permanent Life covers you for life. Knowing the differences is key to making a smart choice.

Term Life Insurance is liked for its flexibility and lower costs. You can pick how long you want coverage, from 10 to 30 years. It’s great for those needing coverage until their kids are grown.

Permanent Life Insurance covers you for life if you keep paying premiums. It also grows a cash value that you can use. It’s perfect for ensuring your loved ones are cared for, no matter when you pass.

A side-by-side comparison of term life insurance and permanent life insurance policies, arranged in a clean, minimalist layout. In the foreground, two transparent glass panels display the key differences between the policies – term length, coverage amounts, and premium costs. The middle ground features stylized icons and infographic elements to visually represent these distinctions. The background is a softly blurred, neutral-toned environment, allowing the focus to remain on the informative visual comparison. Crisp lighting from multiple angles highlights the clarity and simplicity of the display, conveying a sense of professionalism and authority on the subject matter.

Choosing between Term and Permanent Life Insurance depends on your situation. Think about your budget, lifestyle, and future plans. Weighing the good and bad of each policy is crucial before deciding.

Key Factors That Influence Life Insurance Premiums

Several factors affect life insurance premiums. Knowing these can help you choose the right policy and lower your costs. These include age, health, lifestyle, job, and risk factors, all affecting your rates.

Age and health considerations are key. As you age, premiums rise. Older people face more health risks. Pre-existing conditions can also raise costs. Yet, a healthy lifestyle can lower your premiums.

Age and Health Considerations

Other factors like lifestyle and job can also impact premiums. High-risk jobs or activities can increase costs. Smoking or obesity also raises premiums. Knowing these can help you lower your costs and get better coverage.

Lifestyle Impact on Rates

Important factors that affect premiums include:

- Age and health

- Lifestyle choices, such as smoking or excessive drinking

- Occupation and risk factors, such as working in a high-risk profession

- Family medical history

Occupation and Risk Factors

By understanding these factors, you can make better choices for your life insurance. This ensures your loved ones are protected if you pass away unexpectedly. Life insurance premiums might seem complex, but knowing the key factors can help you confidently navigate the process.

How to Compare Life Insurance Providers

Choosing a life insurance policy means comparing Life Insurance Providers. You need to look at their financial strength, customer service, and policy choices. A good Insurance Comparison helps you pick the right policy.

Start by reading Provider Reviews from trusted sources. These reviews share the good and bad about each provider. Also, check their financial ratings, claims process, and customer support. This way, you can find the best policy for your budget and needs.

A row of modern office buildings with glass facades, reflecting the sky and cityscape. In the foreground, various insurance company logos and branding prominently displayed, conveying a sense of competition and choice. The buildings are illuminated by warm, diffused lighting, creating a professional and authoritative atmosphere. A group of well-dressed people, representing diverse demographics, are seen entering and exiting the buildings, suggesting the diverse clientele of life insurance providers. The overall scene evokes a sense of reliability, stability, and the importance of making an informed decision when selecting a life insurance provider.

When comparing life insurance providers, consider these important factors:

- Financial strength and stability

- Customer service and support

- Policy options and flexibility

- Premium rates and affordability

By looking at these factors and reading Provider Reviews, you can confidently choose your life insurance policy. Pick a provider that fits your needs.

Steps to Apply for Life Insurance Coverage

Getting life insurance can seem hard, but it’s key for your family’s future. You’ll need to give personal and health info, get a medical check, and wait for approval. Knowing what’s needed, what the medical check is like, and how long it takes helps a lot.

First, you fill out an application with personal and health details. This info helps figure out if you can get insurance and how much it will cost. Being truthful and accurate is important for a smooth process.

Required Documentation

To apply for life insurance, you’ll need some documents. These include:

- Identification documents, such as a driver’s license or passport

- Proof of income, such as pay stubs or tax returns

- Medical records, including any pre-existing medical conditions

Medical Examination Process

A medical check is a key part of applying for life insurance. It helps the company understand your health and risk level. The check usually includes a physical exam, blood tests, and other health evaluations.

After applying, you’ll wait a few weeks for a decision. How long it takes depends on the company and your application. It’s important to be patient and keep in touch with the company if you have questions.

Knowing the application steps and what you need helps you feel confident. It’s worth it to protect your family’s financial future. Always review your application carefully and ask questions if you’re unsure. With the right insurance, you can rest easy knowing your loved ones are safe.

Common Life Insurance Riders and Add-ons

Having the right life insurance is key. Riders and add-ons can add extra benefits to your policy. They can be customized to fit your needs, giving you more protection and peace of mind.

Popular riders include waiver of premium, accidental death benefit, and long-term care riders. These can be very helpful in certain situations, like if you become disabled or die in an accident. It’s important to think about the costs and benefits of each rider to choose the right ones for you.

Popular Rider Options

- Waiver of premium: This rider waives your premium payments if you become disabled or critically ill.

- Accidental death benefit: This rider provides an additional death benefit if you pass away in an accident.

- Long-term care riders: These riders provide coverage for long-term care expenses, such as nursing home care or home health care.

Cost vs. Benefit Analysis

When looking at Life Insurance Riders and Add-ons, it’s important to weigh the costs and benefits. Think about your budget, health, and financial goals. Adding these riders can make your life insurance plan more comprehensive, tailored to your needs.

Life Insurance Riders and Add-ons offer valuable extra coverage and benefits. By understanding your options and making informed choices, you can get a life insurance policy that gives you peace of mind and financial security for you and your loved ones.

| Rider Option | Description | Cost |

|---|---|---|

| Waiver of premium | Waives premium payments if you become disabled or critically ill | Varies by policy |

| Accidental death benefit | Provides an additional death benefit if you pass away in an accident | Varies by policy |

| Long-term care riders | Provides coverage for long-term care expenses | Varies by policy |

Conclusion: Securing Your Family’s Future with the Right Coverage

Life insurance is key to financial planning, offering great protection for your family. It helps ensure your loved ones are safe, no matter what happens. By looking at the different life insurance coverage options, you can protect your family’s future.

Choosing between term life or a permanent policy depends on your needs and budget. Think about your age, health, and lifestyle to make the best choice. This way, you can give your family the financial security they need.

Life insurance is more than just planning for the unexpected. It’s about making sure your family’s future is secure. Take the time to look at your options, compare providers, and pick the right coverage. This will protect your loved ones for many years.

FAQ

What is life insurance?

Life insurance is a deal between you and an insurance company. They agree to pay a death benefit to your loved ones if you pass away. You pay them premiums in return.

How does life insurance work?

You pay premiums to the insurance company. If you die, they pay the death benefit to your chosen beneficiary.

What are the key benefits of life insurance coverage?

Life insurance gives your family financial security. It covers funeral costs and helps keep their lifestyle the same. It also helps with long-term goals like retirement.

What are the different types of life insurance policies available?

There are several types of life insurance. These include term, whole, universal, and variable life insurance. Each has its own benefits and features.

How much life insurance coverage do I need?

Your coverage needs depend on your income, debts, and goals. Think about future expenses like retirement and education. These factors help determine how much you need.

What are the key differences between term life insurance and permanent life insurance?

Term life insurance covers you for a set time. Permanent life insurance, like whole or universal, covers you for life. Term is cheaper, but permanent can grow in value.

What factors influence life insurance premiums?

Premiums are based on your age, health, job, and lifestyle. Young, healthy people with safe jobs pay less.

How can I compare life insurance providers?

Look at a provider’s financial strength, customer service, and policy options. Reading reviews helps you choose the best policy for you.

What is the process for applying for life insurance coverage?

You’ll need to share personal and health info, and possibly get a medical check-up. Then, you wait for approval. Being prepared and knowing the timeline helps.

What are common life insurance riders and add-ons?

Riders like waiver of premium and accidental death benefit add to your policy. They offer extra benefits. But, think about the cost before adding them.